How AI is Shaking Up Traditional Banking

Finance industry can save time and money using artificial intelligence.

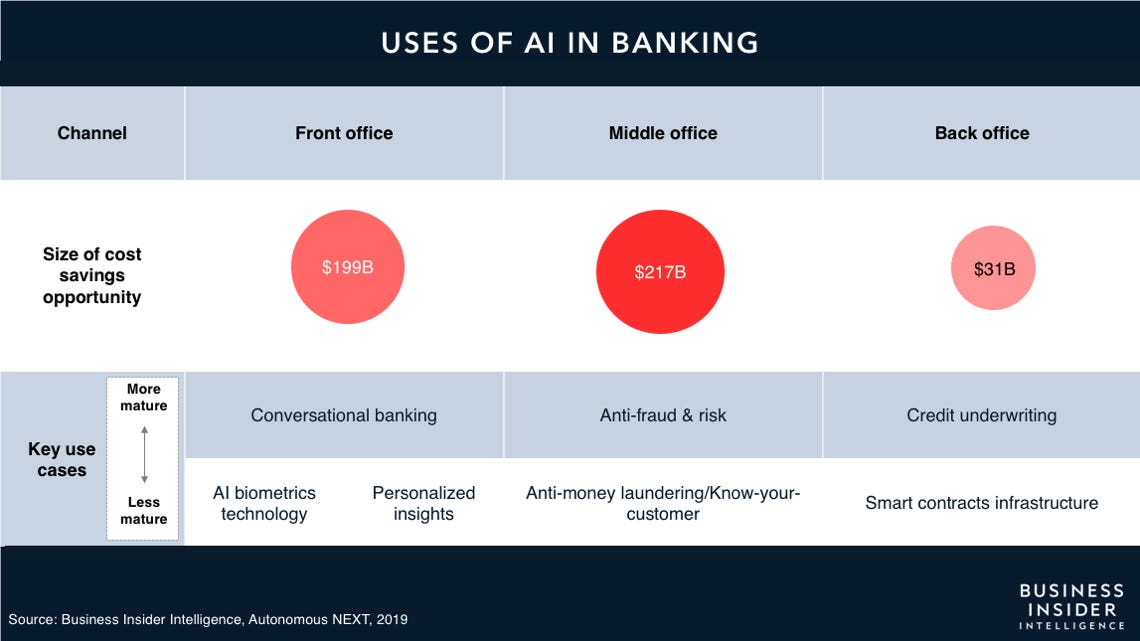

According to the Business Insider Intelligence report of 2020, 75% of respondents at banks with over $100 billion in assets say they're currently implementing AI strategies, compared with 46% at banks with less than $100 billion in assets. Applying artificial intelligence could generate more than $250 billion in value across the sector, according to McKinsey Global Institute. Finance industry can save time and money using artificial intelligence. Artificial intelligence can generate investment insights, improve customer services, and make accurate predictions about company sales performance and churn.

AI-powered computers can analyze large, complex data sets faster and more efficiently than humans. It can be used for identifying trading patterns across different markets in real-time, taking advantage of its computational power and big data processing power. Financial institutions utilize natural language processing (NLP) to analyze keyword searches within filings, transcripts, research and news to discover changes and trends in financial markets. Traders and bankers use NLP for data mining in a way that is the same as how banks use it to mine social media data for endorsing and credit scoring purposes. Traders use NLP for investment purposes as the system could scour web news about mergers and procurements, and to look for the sentimental around some companies for ideas on how consumers are reacting to them, giving them the ideas on which stock is likely to ascend or fall allowing them to make an informed decision on what to do with a client’s stocks. This sentimental analysis of NLP is what provides the investors with insights into which stock to buy and sell for the clients.

Overall, financial institutions are developing a competitive edge through artificial intelligence, building their own AI model framework and feedback validation loop. The availability of artificial intelligence tools at the fingertips of firms offering financial services like voice and facial recognition gives them the comfort to track, monitor, and predict the behavior of customers and employees when working. However, any misuse of these systems can cause systematic risks, momentous societal and customer harm, accountability under the SMCR, operational resilience, safety, transparency, and data bias approaches are to be considered.

Learn More About Allganize's Technology